Understanding the 1099-NEC and Changes to the 1099-MISC

Legislation passed by Congress in 2015 moved the filing deadline for non-employee compensation from March 31 to January 31. As a result, the 1099-MISC form had two filing deadlines – one for non-employee compensation (box 7) and another deadline for everything else.

The different filing deadlines for the same form created confusion.

To address this filing date confusion, the Internal Revenue Service (IRS) is making two significant changes for 2020.

First, the IRS will reinstate the 1099-NEC (Non-Employee Compensation) form for 2020. Not used since 1982, this form will have a January 31 filing deadline and will only be used to report non-employee compensation. This amount was previously reported in box 7 of the 1099-MISC form for 2019 and previous tax years.

Second, the IRS will also redesign the 2020 1099-MISC form. In addition to removing the non-employee compensation box, the IRS plans to rearrange other boxes. Box 7 will now include only “Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale” — which was previously entered in box 9.

The IRS has posted draft versions of these form changes on their website. You can review these draft forms here:

- 2020 Form 1099-NEC (.pdf)

- 2020 Form 1099-MISC (.pdf)

- 2019 Form 1099-MISC (.pdf)

How do These 1099 Form Changes Impact Acumatica?

Please Note: The actual implementation of 1099-NEC will likely be different than what is described here. The information provided below is for planning/discussion purposes only.

To accommodate the new 2020 1099-NEC form and changes to the 2020 1099-MISC, Acumatica will need to consider changes to multiple screens and reports. Acumatica plans to make these changes to all versions supported in 2020, which includes 2018 R2, 2019 R1, 2019 R2, 2020 R1, and 2020 R2. Customers running earlier versions can request a quote for a customization package.

The follow provides an overview of some potential changes to Acumatica:

Processing Accounts Payable Bills

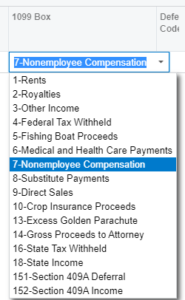

Changes to the vendor bill entry process in Accounts Payable seem unlikely. Currently, Acumatica displays a field labeled 1099 Box which defaults to the value specified for vendor. The process for identifying the 1099 vendor and the corresponding 1099 settings require no changes.

Changes to the vendor bill entry process in Accounts Payable seem unlikely. Currently, Acumatica displays a field labeled 1099 Box which defaults to the value specified for vendor. The process for identifying the 1099 vendor and the corresponding 1099 settings require no changes.

Additionally, because Acumatica properly stores the necessary reporting values in the database, Acumatica can easily adjust labels, reports, and filings support your vendor settings and the tax year for which you are generating a 1099-MISC/1099-NEC form.

New 1099 E-File Screen Required for the 1099-NEC Form

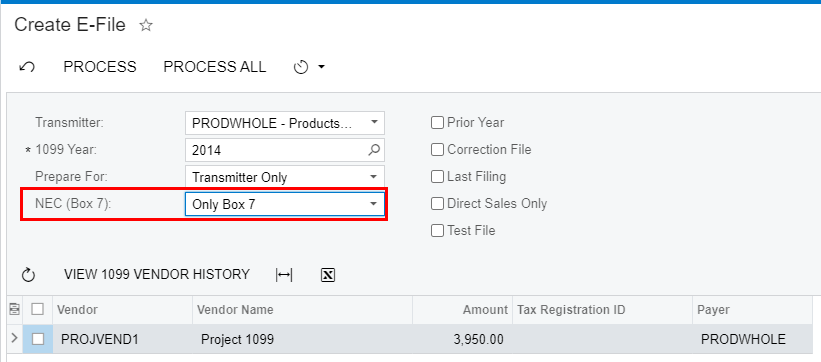

Acumatica will likely add a new 1099-NEC E-File screen that is similar to the current Create E-File screen. However, it is important to note that the 1099 E-File screen, used for the current 1099 MISC form, already includes the options necessary to file 1099 tax reports for the 2020 and 2019 tax years.

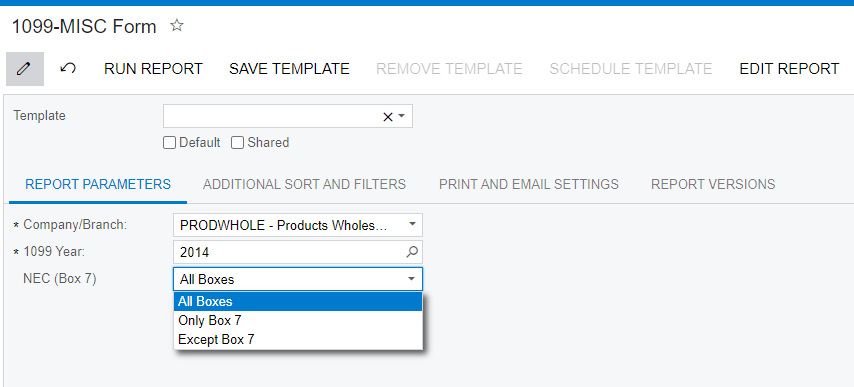

The NEC (Box 7) field allows you to select options that support 1099-MISC form requirements for pre or post 2019 tax years. For example, selecting the:

- All Boxes option creates 1099-MISC filing for 2019 and earlier

- Only Box 7 option creates a 1099-NEC filing for 2020 and beyond.

- Except Box 7 option creates a 1099-MISC filing for 2020 and beyond

1099 Reporting

Acumatica will modify several report formats to accommodate the 2020 tax year. When making these changes, Acumatica anticipates adding support for one or more 1099-NEC report. As the setting needed to support the 2020 1099-MISC form is already in place, it is simply a matter of adjusting the forms to match the required format for your selected tax year.

Note: There may be additional reporting changes that are not covered here.

Conclusion: Acumatica Will Provide Support for 1099-NEC

Acumatica will have a solution in place to support the IRS tax changes. These changes will provide a solution to print the 2020 1099-NEC and 1099-MISC while minimizing data migration and changes to existing data entry processes. The specifications for these changes are expected in late July or early August 2020, so stay tuned for more details.