How to Use the New 1099-NEC Form for 2020

Confirmed: Form 1099-NEC Is Available in Acumatica Cloud ERP and Is Coming for Later Versions of Microsoft Dynamics SL

For your 2020 taxes (filed in 2021), the IRS has revived an old tax form last used in 1982. This form, called the 1099-NEC, will affect your filing requirements for all non-employee compensation, including freelance, contracted, consultant, or vendor-based work. The 2020 1099-NEC will replace Form 1099-MISC for reporting most non-employee compensation.

This brief guide is meant to help CEOs and their staff avoid noncompliance or information return errors by providing key facts on the revived Form 1099-NEC.

- What Is Form 1099-NEC?

Form 1099-NEC is used to separate out Box 7 from Form 1099-MISC, which had previously been used to report non-employee compensation (NEC). The IRS chose to revive the old Form 1099-NEC because Form 1099-MISC had different filing dates for Box 7 versus everything else on the form.

- Why Did the IRS Change the Forms?

The PATH Act (Protecting Americans from Tax Hikes Act) of 2015, enacted on December 18, 2015, changed the due date for Box 7 on Form 1099-MISC from February 28 to January 31 and eliminated the form’s automatic 30-day filing extension.

As you can imagine, this change created a time management and paperwork issue at the IRS, and forms that arrived late at the IRS were subject to fines. By separating Box 7 from the 1099-MISC, due dates make more sense and the forms are less of a hassle for your business as well as the IRS.

- How to Use Form 1099-NEC

Form 1099-NEC is used to report non-employee compensation (NEC) that had previously been reported in Box 7 of Form 1099-MISC. The 1099-NEC should be used to report payments to freelancers, contractors, consultants, or vendors (you may know them as “1099 workers”).

Businesses must file a 1099-NEC if all the following conditions are met:

-

- The payee is not your employee

- The payee provided services that you used in the course of your trade or business

- The payee is an individual, partnership, estate, or corporation

- The payee received more than $600 from your business for the year

Some examples of these include attorneys, accountants, consultants, fee-splitting between professionals, and services payments for related parts or materials.

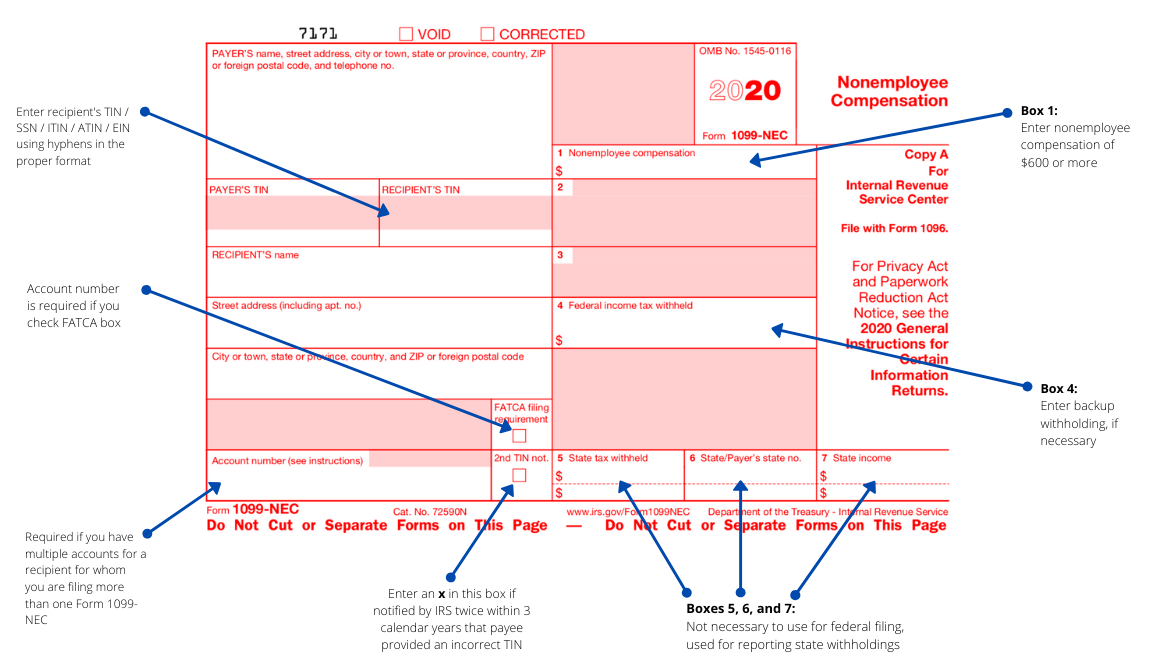

You must also file Form 1099-NEC for anyone for whom you withheld federal income tax under backup withholding rules for any amount, even if it is for less than $600. (This situation would use Box 4 of the form.)

Form 1099-NEC should not be used for:

-

- Payments for merchandise, telegrams, phone, freight, storage, or similar items

- Payments to tax-exempt organizations, such as trusts and governments

Here are some tips to help you fill out Form 1099-NEC properly:

-

- Always use the most current, accurate taxpayer ID you have on file

- Do not use for employee wages (use Form W-2 instead)

- Do not use for personal payments

- Do not use for rent payments (use 1099-MISC instead)

- Do not use for gross proceeds to an attorney (use 1099-MISC instead)

- When Should You File Form 1099-NEC?

Each year, your company should expect to distribute Form 1099-NEC to payees and file the form with the IRS by January 31. However, since that date falls on a Sunday next year, the form will be due to payees and the IRS on February 1, 2021.

- Where Can You Get Copies of Form 1099-NEC?

To prepare for next year, you can download copies of Form 1099-NEC from the IRS website, or you can order paper copies from the National Distribution Center.

If you choose to order paper copies, note these two important caveats:

-

- The National Distribution Center only recently reopened after being shut down due to the Coronavirus pandemic, so you may experience delays in receiving your forms.

- As per the Taxpayer First Act, businesses with 100+ forms to file must e-file in 2021.

- Should Your Company Still Use Form 1099-MISC for 2020?

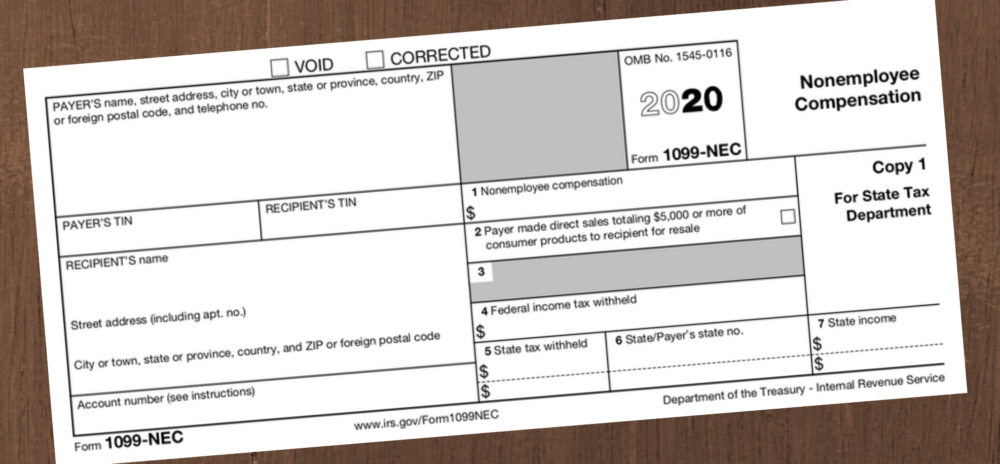

As a result of moving non-employee compensation away from Box 7 of Form 1099-MISC, the form has been redesigned and will now be used for reporting all other types of compensation.

Because you will likely still use Form 1099-MISC on your 2020 taxes and beyond, the most important redesign change to be aware of is Box 7, which now reports direct sales of $5,000 or more. Other boxes on the form have been renumbered, so be very careful to ensure that your team enters data in the correct boxes for your 2020 filing.

- Microsoft Dynamics SL and Form 1099-NEC

The Microsoft Dynamics SL 2020 year-end updates have an anticipated release date of December 18th and include support for the new 1099-NEC form, plus:

- Updated 1099-MISC form

- Support for Standard and High Withholding for state deductions

- Allowing different marital status for state and federal exemption and credits

Supported Versions: Microsoft Dynamics SL 2018. Support from Microsoft for all previous versions of SL has expired.

If you are on an earlier version of Microsoft Dynamics SL, there are options for you:

- Upgrade to Microsoft Dynamics SL 2018

- Third Party Year-End Update Package for Microsoft Dynamics SL 2011 SP2, SP3, FP1 and SP4, as well as ALL versions of SL 2015

- External Filing Service for all versions of SL

Please contact us for details on how you can file Form 1099-NEC if you are running a version of Dynamics SL earlier than 2018.

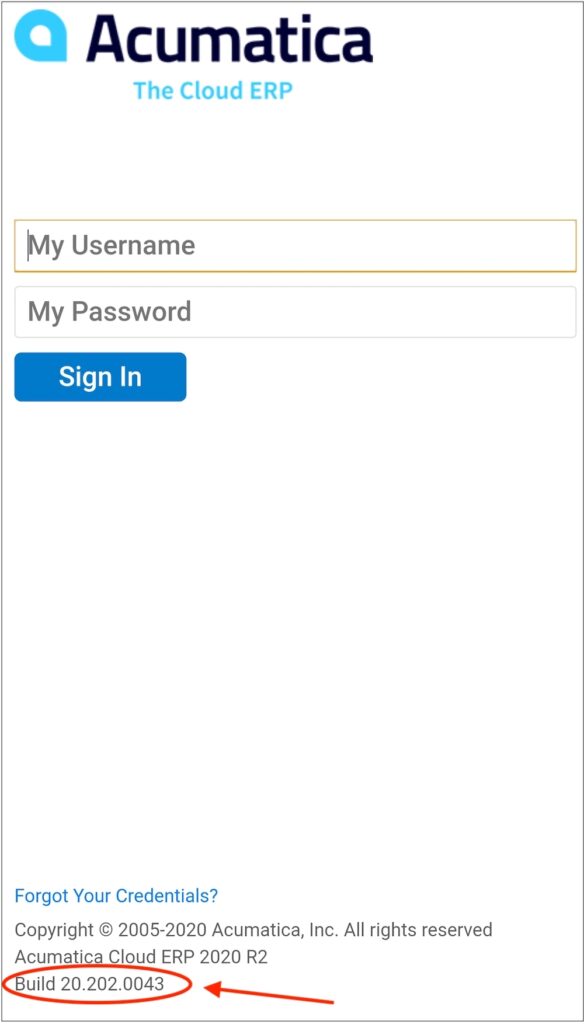

- Great News! Acumatica Supports Form 1099-NEC!

Acumatica Cloud ERP helps make all your business management tasks easier and faster, including your 1099-NEC filing. Form 1099-NEC is supported on the following Acumatica builds:

- 2018 R2: update 21 – 18.221.xxxx or higher

- 2019 R1: update 20 – 19.120.xxxx or higher

- 2019 R2: update 13 – 19.213.xxxx or higher

- 2020 R1: update 09 – 20.109.xxxx or higher

- 2020 R2: all versions

Not sure which Acumatica build your company is running? Check by taking a look at the bottom of your login screen, where the build number is listed.

If you are on a build of Acumatica that does not include the 1099-NEC update, you can request an upgrade for 2018 R2 or above — or a quote for a customization packages for prior versions. Please contact us for details if you are not running a supported build.

Have other questions about how to access Form 1099-NEC? Please reach out to SWK Technologies for quick, clear answers.